Get the Right Tax Advice at the Right Time

Tax Consultancy Services

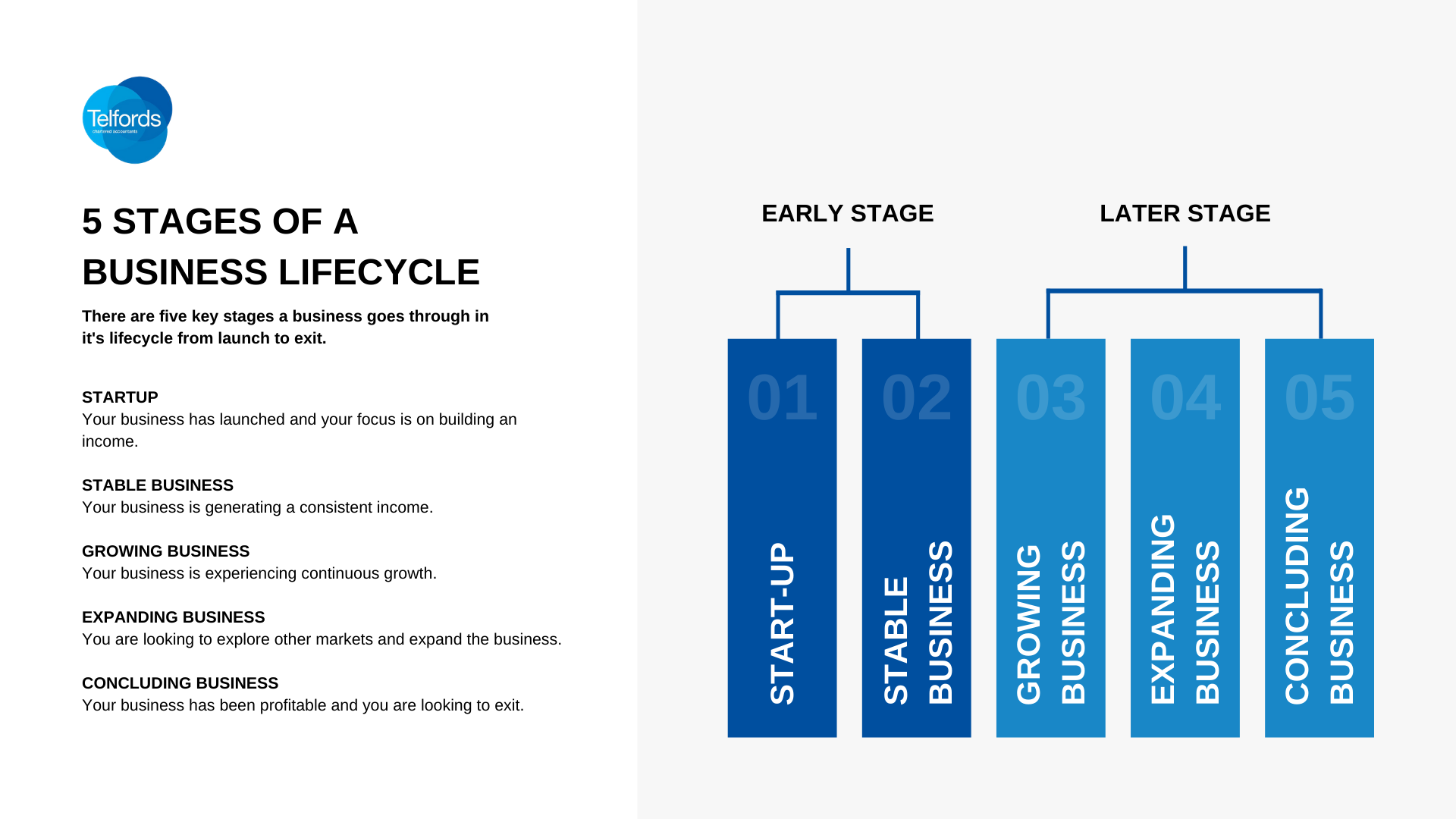

There are five key stages a business will go through in its life cycle from launch to exit.

At each stage there are different tax advice options to consider, to make sure you are paying the most efficient amount of tax.

Early stage start-up

This is where starter planning is vital

Ensuring you pay yourself in the most tax efficient way, the right split between salary and dividends (which isn’t always obvious).

Our standard service for tax consultancy is that we do the salary and dividends planning for you. We calculate the best split, to make sure you get paid in the right way.

Small, stable business

This is where it becomes important to make sure you are extracting value from your business in the right way.

We explore the different ways you can tax efficiently put things through the business or take value out of the business to benefit yourself as the business owner.

Growing business

As your business grows, the directors and shareholders can look to maximise their takings, invest in the business and also look at mitigating chargeable profits to corporation tax.

Expanding business

At this stage the business is investing in and disposing of assets, reinvesting in the business to expand.

At this stage its important to look at the structure of the business and consider whether its better to look at expansion in the UK or overseas.

Concluding a business

At least 3 years before you plan to exit your business, whether that’s through a sale or succession its important to undertake a review and think ahead.

At this stage it’s a full 360 tax review to make sure you’re fully optimising your tax position.

Find out more

Whatever stage you’re at in your business we have a tax service that is right for you.

To find out more about how we can help you make the right business decisions and make sure you’re paying the most efficient amount of tax, please get in touch.