Building Something Exceptional

As you’d expect, I’m always looking into where I could be making more tax-efficient decisions. And this is especially important given my business plans.

You see, I don’t just want to build any old business; I want to create something exceptional. By that, I mean something that I can be proud of, and that serves my clients in the best possible way.

But let’s face it: I won’t always be around to look after things. Though I love serving my clients, I imagine there will come a point where I do want to retire.

Now I’m shocked…I never thought that 6-letter word would ever pass my lips!

But life does take its course and while I find it hard to imagine myself buying a little cottage, putting my feet up, relaxing at the pub and going on long countryside walks with my family, that could very well be what the future has in store! That means I need to build my business in such a way that it can operate sustainably without my constant, daily input.

For now, I plan to put in 100% over the next five years. Then I can gradually reduce my time. I want to capitalise on the work I’ve done while retaining some ongoing income from the efforts and assets I’ve built.

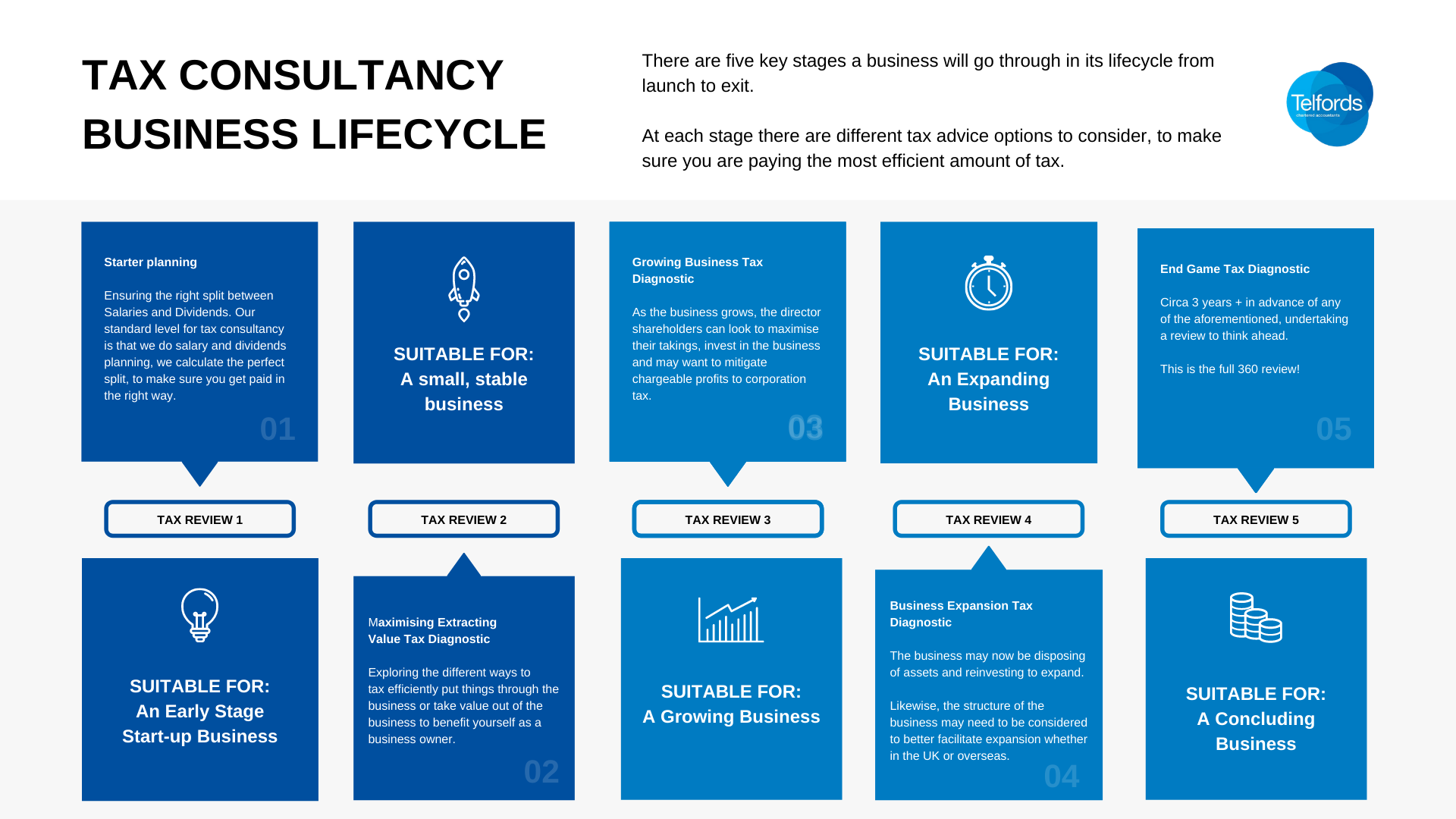

Growth and Individual Tax Diagnostic Reviews

Out of the four different levels of tax diagnostic, I completed the growth and individual tax diagnostic reviews. That made sense to me as I didn’t just want answers about my business but also what I could do from a personal tax perspective to ensure I’m growing and storing wealth for my family and our future.

Out of the areas that came up, there were three that stood out to me:

- Maximising the value of extraction

- CGT tax on land

- Inheritance tax

Here’s what came up in each of these categories for me in more detail below.

Maximising the value of extraction: From working hard to hardly working

As mentioned before, my plan is to have a business that can be sustained without me. One that I can gradually extract myself from while still reaping the rewards of the assets I’ve built and the effort I’ve put in.

What’s interesting is that this has very much become a family business, and that’s where there are significant tax advantages. Both my wife and daughter now work for the company. So it makes sense to spread the income I’m making between myself and my wife.

In fact, it’s well known that income splitting is one of the best ways of reducing income tax and capital gains tax. While spouses are treated as separate individuals for tax purposes, they are allowed to pass assets between themselves. The best part is? No capital gains tax arises. Also, the fact that my wife and daughter work for the business means we can maximise personal allowances and take advantage of lower-level tax bands.

In the same breath, I’d like to maximise pension pots for both my wife and daughter. I’d like to build up a nest egg which provides both me and the missus enough to live off of and enjoy our life in retirement as an income. I’ve worked it all out – what that amount needs to be, how much the business needs to make to get me there, etc. That’s given me absolute clarity on how I need to drive the business forward.

On a side note, the business rents a barn on my property as an office, so I’m sure there are other tax efficiencies to take advantage of this. I’d also like to buy my wife an electric car; she’s been eying up a nifty green 5-door Volvo. That would be a good way of benefiting from no benefit-in-kind.

CGT Tax on land: Sowing seeds and reaping the rewards

I have roughly 5 acres of land with my house that’s prime for redevelopment. Now that’s a real asset. Plus, it has been included in local strategic development planning, which means there’s a high chance it will get planning consent within the next 10-15 years. That’s if we want to develop.

In all likelihood, we’ll probably end up moving in that timescale, in which case we want to downsize. That should be a good opportunity to sell some of this land and explore other options.

In the meantime, I’ll certainly be making sure I’ve got the proper structure in place to ensure this asset is taken care of in the most tax-efficient way possible, both from a CGT and IHT point of view.

Inheritance tax: Children are life’s greatest gift

Last, but certainly not least is inheritance tax. Now, this is of great importance to me but not in the sense you might think. Our children are 13, 17 and 19 at the moment. And when it comes to their wellbeing and happiness, it’s important for me to support them in the best way possible, without simply handing them a privileged existence.

I want their life to be easier than mine, that’s a fact. But I also recognise the importance of not simply handing them everything on a silver platter. In other words, it’s about taking them so far and letting them do the rest themselves. I will help them and support them as much as I can to enable their dreams, but they’ve got to show the drive to want to make them happen.

What does the future have in store?

In terms of where I’m going, that still seems pretty clear. Putting a succession plan together so I can continue with part ownership of the business for at least the next 15 years while gradually moving away seems the most sensible course. Once I’m on course for this, I’ll probably want to take another tax diagnostic, more focused on the end game to explore suitable ways to retain elements of the business.

Planning for the future?

At Telfords Accountants, we build better businesses and lifestyles for ambitious business owners.

Book in a call to find out more about a tax diagnostic review can help you get there.